After navigating the rough retail waters of 2015, Bearpaw President John Pierce reveals why the brand is headed for

a successful year—thanks in part to a growing kids’ collection.

It’s a tale as old as retail: A certain style or product becomes a runaway bestseller. The market’s early innovators rack up sales but must fend off competitors eager to cash in on the fad. Eventually, the trend begins to wane—or does it?

Sometimes the item becomes a fashion staple, destined to last for decades. That’s the case for shearling boots, suggests John Pierce, the president of Bearpaw—maker of the now-ubiquitous boot. The company, founded in 2001, first rose to success when CEO Tom Romeo stumbled into a lucky find: a Chinese manufacturer looking to unload 50,000 pairs of sheepskin boots. The timing couldn’t have been better. Oprah had just named UGG’s version one of her favorite things, and sales of the cozy boots were booming. But the market was missing a mid-price alternative (with the exception of EMU Australia, which was stymied by internal problems). Enter Bearpaw. Within five years, the company was selling 1 million pairs a year.

What are you reading right now?

Other than the 500 emails I get a day, I don’t really have any time. But if I were to read a book, my dad just published his life story. He made about 75 copies for family and friends.

What word describes your outlook right now?

Positive. People always ask me, “Why are you smiling?” I tell them, “It’s just shoes.” I enjoy what I do, so I’m going to stay positive.

What’s your favorite way to spend a free afternoon?

On the couch watching sports.

What three items would you bring to a deserted island?

I’ve got a wife and three kids. Can my twins count as one? Then I can get it down to three.

A veteran of the footwear industry with experience on both the retail and manufacturing ends of the business, Pierce came on board at Bearpaw in 2010 as the brand’s national sales manager. He was introduced to Romeo when the two were partnered together during Famous Footwear’s annual golf outing. “By the end of 18 holes, he said he needed to try and find a way to get me on board,” Pierce recalls.

Since then, Bearpaw has grown steadily, thanks in part to several factors, including an expanded fashion collection filled with on-trend details and a bigger focus on the kids’ market, where Pierce sees plenty of opportunity for increased sales. To facilitate that growth, the brand reduced the price for core kids’ styles by $10 (to $49.99 retail) and hired a new designer with experience in the juniors’ market to provide a more colorful, playful and kid-friendly assortment.

Pierce is the first to admit that 2015 was a tough year—due in part to the weirdly warm fall temperatures. As a result, reports of the demise of the shearling boot have been greatly exaggerated, he adds. “I think it’s going to stick around because it’s a staple item in every woman’s closet, kind of like a flip-flop in summer. There’s always going to be a need for it,” he posits. The key for Bearpaw is to continue to evolve beyond the classic sheepskin boot silhouette, offering thinner, shorter crop-height boots for a more feminine look, as well as wedges, sandals and slip-ons. “At this point in time, we’re nowhere near where we can be as a total company, but the awareness is growing,” he continues. “Moms know our boots, and what they stand for—the comfort factor. And if she sees a different style on the shelf, she is going to be comfortable giving them a try because of the experience she’s had in the past with our boots.”

Thankfully, Pierce adds, Bearpaw’s retailers are completely on board with the brand’s expansion—and a lot of the credit for that can be attributed to Pierce himself, who constantly solicits feedback from the company’s buyers. “I firmly believe in listening to the retailers,” he adds. “I firmly believe that if you know what their needs are and how they operate, it will make things easier for us moving forward. You can’t be so arrogant that you think you know everything.”

No surprise, considering retailing runs in the family. Pierce’s father, Ray Pierce, worked his way up the ranks at JCPenney, retiring after 34 years as the president of the company’s private label business. Pierce was at first reluctant to follow in his father’s footsteps. “I was a huge sports fanatic, and growing up I wanted to work on the manufacturing side, for a Nike or a Titleist,” he remembers. Not to mention, he didn’t want to be known as “Ray Pierce’s kid.” So after graduating college, he managed a Foot Locker for seven years. When one of his father’s colleagues offered him job at JCPenney as an athletic footwear buyer, he reconsidered his stance. “I learned quickly that people are always going to think you don’t belong where you are for all sorts of reasons, and you have to be thicker-skinned than that.”

It’s safe to say the seasoned industry vet has earned his stripes. Even after last year’s challenges, Pierce remains optimistic about the state of retail overall, and predicts 2016 will be another successful year for Bearpaw. “Every day we progress and improve a little more,” he points out. “We’ve got plenty of room to grow. We’re still a small company in the scheme of things, but in my six years, we’ve made a lot of huge strides in terms of what we want to do and where we want to go.”

How did last year’s tough retail climate impact your business?

There are some people out there who want to find a reason for the shearling business to go away, and anytime there’s a bump in the road, they like to claim it’s done. But we experienced something like this in 2012—that fall/winter was very similar. And in 2013, people overcorrected and underbought, and they were in chase mode throughout that year. And we had a banner 2013. We’re planning for the same next year. However, no one really predicted the slowdown in classic styles, I will say that. That’s kind of a head-scratcher.

Customers are moving away from the classic boot?

When I started with the company, classics were 80 to 85 percent of our total business. In 2015, it was about 55 percent of our total business. So that percent total is going down, while our annual revenues continue to go up. And the reason for that is because we’re offering a lot of different products—a much bigger assortment that gives retailers the ability to expand beyond the classics. This year was abnormally slow, and we really can’t put a finger on it, other than the lack of a winter—and even a lack of fall. Our fashion products actually sold through pretty well. So if women were going out and buying, they were buying fresh and new product as opposed to that classic style they may already have in their closet.

Did Bearpaw also see a slowdown in kids’ classic styles, too?

We didn’t see it as much in kids’ as we did on the women’s side. That’s probably because our women’s side is a more mature business than what we’ve been doing in kids’. There’s still plenty of growth to be had on the kids’ side.

And kids get bigger every year, so even if it’s a pair of brown shearling boots, moms still have to buy it every year.

That always helps. And we try to introduce new colors and prints every season, to give our customers a reason to buy something else to put in their closet.

How important is the kids’ category for Bearpaw?

We’re putting more focus on it because we’ve seen some growth. It used to be 14 percent of our total business, but now it’s closer to 18 percent. As our total revenues grow, and that percent to total grows, it’s becoming more and more important. On the kids’ side, 60 percent of our sales on Bearpaw.com came from classic styles, and 40 percent came from fashion boot purchases. That’s much closer than it was in years past, when it was more like 75/25. The fashion element is something moms are looking for, whether it’s cute bows, embroidery, appliqués or glitter.

At the end of the day, eye-catching product is key.

We hired a new designer in March of last year. She comes from a juniors’ background with Chinese Laundry and MIA, so she offers a different perspective. We had a gentleman running the department previously, and his approach was just to offer takedowns. Build a women’s line and whatever may work, take it down to kids. And you can’t do that.

That’s interesting, because I always hear that today’s moms want to dress their daughters like themselves—thus the growing Mommy & Me trend.

There’s still plenty of crossover between our women’s and kids’ styles, but we also have to introduce new silhouettes just for kids. Kids are growing so fast—some girls are in women’s sizes by the 4th grade. But you have to remember that they’re still little girls. Not all moms want their kids to look like mommy, and not all moms want their kids to grow up so fast. You have to keep that in mind and make sure you’re offering something that’s kid-friendly.

My last editor’s note touched on this topic. I suggested retailers offer kid-friendly styles in larger sizes.

Our kids’ sizes used to go to a size 4. Two years ago we took it up to a size 5. And there are times when our customers ask, ‘Can you take it to a 6?’ Not only because the price is better, but also because they have young girls who aren’t ready to make the jump to women’s. In fact, we changed our size runs in kids’—which also makes it more conducive for sell-through for our retailers. Before, our toddler runs were 5 to 10 and our youth runs 11 to 4. We eliminated the sizes 5 and 6 in our toddler collection, because it seemed like retailers were always stuck with the smaller sizes. By taking our toddler sizes up to a 7 to 12, and our youth sizes up to a 13 to 5, we’re saving mom a few extra dollars a year.

Right. Price will always be a big consideration in the kids’ market.

When I first came on board at Bearpaw, we were doing sheepskin linings in kids’ boots, similar to what we did on the women’s side—but our price points were difficult because we were around $59 on a basic pair. Our women’s boots were $69, so there was only a $10 difference between the two. In 2012, we made the decision to go to a wool blend lining with a sheepskin footbed, which allowed us to bring the price down to a more affordable rate of $49.99. That really jumpstarted our kids’ business.

What are some of Bearpaw’s bestselling kids’ styles?

Our Harper boot, with a V-cut and a little bow on the back, did very well in Fall ’15. As did the Macey, a non-functional lace-up (so moms don’t have to worry about tying the shoes) with cold-weather elements like exposed fur. The Kelly is another popular cold-weather style we introduced last year.

So in a year with a weirdly warm winter, cold-weather boots were bestsellers?

Yes, we saw that on the women’s side, too. Even though there was no snow on the ground, the sell-through on that type of product was still pretty solid, even in early October. Whether it’s the popularity of Sorel, or another brand leading the charge, there is a definite fashion element behind it. It’s not all about function. We introduced the Kelly boot in Fall ’15, and the sell-throughs on it were so outstanding that we added three similar kids-only styles for Fall ’16.

You’ve adjusted your kids’ design and price points. Has your retail strategy changed over the years?

It really hasn’t changed much. Our main account base is DSW, Shoe Carnival, Famous Footwear, Shoe Show, Shoe Dept., Bob’s and independent retailers across America. We’re firmly entrenched in the mid-tier market as the go-to [shearling boot] brand. It’s all about quality and value. We offer great margins for the retailer and great value for the customer.

What about e-commerce? Are direct-to-consumer sales a big part of your business?

Right now, it’s only about 3 percent of our total business. Our current focus is building our email base and exposing more people to the brand. We’re a full-price site. We never run any promotions—even in difficult times. The intent is to showcase the entire brand and let people see everything we have to offer.

I’m sure your retailers appreciate that!

Very much so. The last thing they want to do is compete with us. It’s hard enough competing with Amazon—which is a big eyesore for us. In 2015, we initiated a MAP policy to level the playing field for all of our retailers. That’s another reason we want to make sure we maintain the integrity of the price on Bearpaw.com.

How do you deal with a behemoth like Amazon?

Last year we decided to stop selling to Amazon directly. Any product that’s on there is through third party sellers. That’s the difficult piece—they don’t prohibit anyone from selling on their third party marketplace. And I believe they use that marketplace to drive prices down so then Amazon itself can match them, because Amazon’s mantra is to be the lowest price on the Internet. By removing the behemoth from the equation, we can start to bring everybody else in line [in terms of pricing] and make sure everyone is playing fair.

It sounds like the brick-and-mortar channel is still a big focus.

We do plenty of business with online-only

retailers, but my concern is they’re always the most difficult to control. And as for the omnichannel discussion that everyone is having now, everything you read says the customer is still going to the stores. Sometimes they are using the website to find a price or a product, but they are going to the store to try things on—especially when it comes to footwear. We still firmly believe in brick-and-mortar, but we know we have to be conscious of the fact that the Internet is growing.

How do you plan to grow your kids’ business going forward?

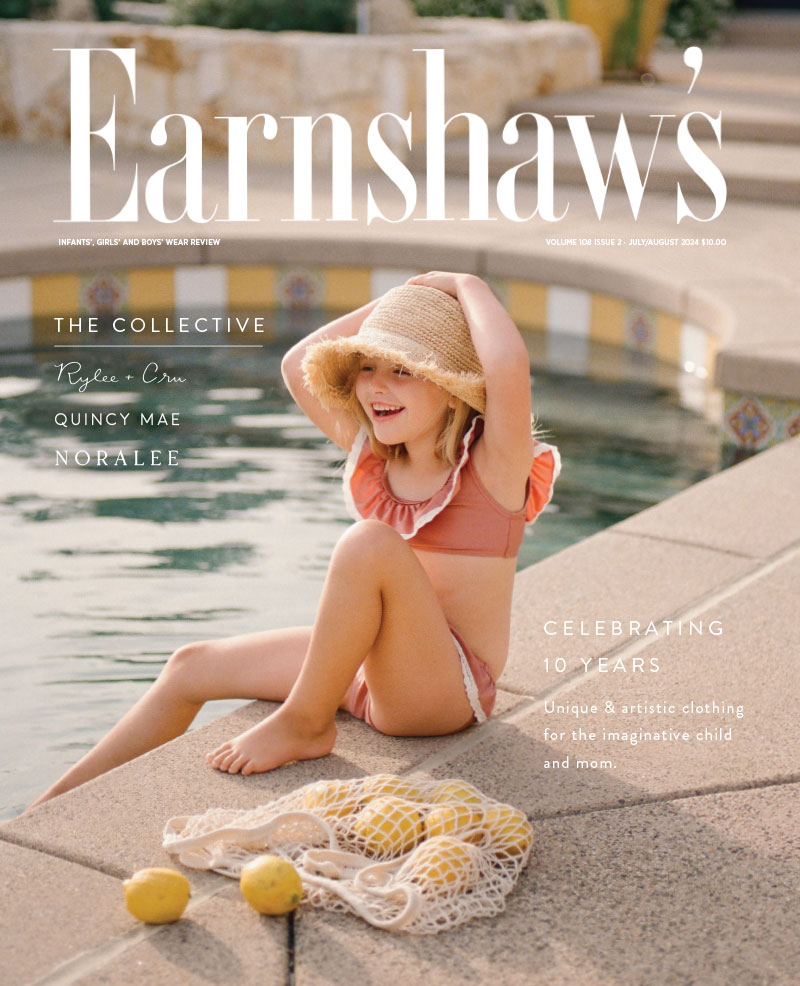

One thing we haven’t done is really build awareness on the kids’ side. Giving Earnshaw’s more attention is one part of the plan. We’re going to start to spend more in marketing, because we’ve had a low percent-to-revenue marketing spend, and I think it’s important as we continue to grow and introduce new product, that we spend more on that front.

That’s a refreshing approach. Many brands cut back on marketing during tough times.

That’s the easy way, but if anything you should spend more in a down time, because you still want to stay in front of the public. You still want to have an ongoing dialogue with your customer.

How about spring styles? Any potential for growth there?

Yes. We tried a spring line for the first time in 2013, and we’ve been evolving since then. For Spring ’16, we’re offering sandals and canvas, jute-wrapped slip-ons. If we could make that 10 percent of our total [kids’] business, it would be a nice spring business to have. Our key partners have stepped up and are giving us a shot because of what we’ve meant to them for the fall season. Last year one of our bestsellers in kids’ was the Arizona, a Birkenstock-style sandal at an affordable price point.

How do you know what styles to add to the collection?

By listening to our customers and to our accounts about what’s working in the marketplace—and what makes sense for Bearpaw. One example: This year we added a side zipper to our classic Emma boot in the toddler range, to make it easier for mom to get the shoes on. That’s because Famous Footwear came to us last year—They wanted to add our toddler styles to the mix, but the store’s buyers said it’s got to have a zipper.

Looking ahead, what’s the biggest challenge for Bearpaw?

Coming off a tough year like 2015, our biggest challenge is getting people to continue to buy into the brand. I’ve been in front of all our major partners, and they’re all on board. They know it was a difficult year, but they don’t see the demise of shearling boots. Another challenge for us, because we’re a bigger player (We’re No. 2 in market share in terms of this type of product.) is there’s more competition. Deckers bought Koolaburra with the intent of bringing a mid-price product to the market, and I know that’s to come after us. Now that we’ve got more competition, we have to make sure we continue to innovate. We have to continue to offer freshness and newness and deliver—on time—the same value and quality our buyers expect.

Leave a Comment: